Sovereign Life's David McGregor has penned a great summary of the global financial and economic crisis: it's real causes and the only long-term solution.

If you're looking for some clarity as to why the current financial crisis has happened - and what needs to be done to not only fix it, but to ensure such events need never happen again -- then I urge you to read and reflect -- and to download the quoted publication at the conclusion.

The Global Financial/Economic Crisis:

The True Causes And Only Long Term SolutionAs financial and market instability persist, as governments flail and fumble, one thing is for sure - we're on the brink of a most serious economic event - a "depression" which is the BUST component of the typical "boom/bust" cycle.

Popular criticism is centred on blaming the bankers, the financiers, and to some extent the politicians, and the overall lack of "regulation." And above all there is a consensus emerging that it is ultimately the fault of the free market, of capitalism - and that what is needed to "fix" this problem is more regulation, more easy credit (debt), and ultimately more government.

Nothing could be further from the truth.

The cause of the "bust" is the same as the cause of the previous "boom" - the willy-nilly creation of credit out of thin air, for the purposes of creating political and economic advantage in the short term.

To understand the root cause of this crisis you need to understand the root cause of "boom and bust". Contrary to popular opinion, this is not the result of capitalism or the free market, rather it's caused by the nature of the banking and monetary system itself - the way it operates.

The boom cycle is achieved by the three pillars of the global financial system - the "Trinity" of the banking "religion" - which are fiat money, fractional reserve banking, and central banks. When the pyramid of debt generated by this unholy Trinity gets out of control, it must be liquidated, creating what we call the "bust."

Consider these facts:

- Banks lend out more than they take in. The reason banks

can and do fail, is because if all depositors ask for their

money back at the same time, the bank is unable to meet such

a demand. The money is simply not there.- Banks employ what is termed a "fractional reserve" policy,

which means they can literally take in $1 on deposit and

lend out $10. Thus the basis of the banking system we all

take for granted is fundamentally fraudulent. The money you

think the bank has on your behalf is in fact not there. The

business of fractional reserve banking is based on faith and

confidence. In other words, it's a CONfidence trick.- It's fraudulent because banks are lending out money held

on deposit which is supposed to be "on demand" and are

effectively making money on money they do not have, and

have no right to use.- Because of this fractional reserve system, and the essentially

fraudulent nature of it, it's always possible that banks can

fail - if enough depositors suddenly show up to withdraw all

their money. And to avoid this "ugly" scenario, central banks

were created to be "lender of last resort" - in other words to

provide the money (out of thin air) the banks don't have, in

order to make good on their bogus promises. This is designed

to maintain the "faith" in banks.- Central banks manipulate the money supply at will, by

controlling all elements of the fractional reserve process,

by altering the reserve requirements and the total money

supply as and when deemed necessary. Operating under a state-

granted monopoly, central banks wield enormous "hidden"

power.- Governments love fiat money, fractional reserve banking

and central banks, because it allows them access to "free"

money with which to bribe the electorate and carry out their

objectives. It allows governments to appear "generous" by

over-promising on social welfare - and to take aggressive

actions by financing wars and mayhem out of the same

store of "funny money".- Money can be manipulated in this way because it is money

by edict/command - or what is called fiat money. Fiat money

is paper money without any true or inherent value - and is given

"value" simply by government command, via the legal tender

laws in each country. Unlike the money which naturally evolved

during history - gold and silver - fiat money has no natural

constraints and no historical precedent for long term success.

When the state inflates the fiat money supply ad infinitum, then

such money simply loses its purchasing power, becoming a

stealth tax on the people. And when the end-game arrives it

becomes as valuable as toilet paper (but not as absorbent!).- Governments and bankers love fiat money and fractional

reserve banking because they are "partners in crime" and

co-conspirators in the business of engaging in fraudulent

financial transactions - at the expense of the rest of us.- The current financial/economic crisis has its roots in

the expansion of easy credit (debt) - which creates the boom

and bust cycles. This is made possible by loose monetary

policy as initiated by central banks and endorsed by their

political masters - using the mechanisms of fiat money,

fractional reserve banking and central banks.The only solution to all these shenanigans is to unwind the CONfidence trick, and de-nationalise the world's money:

- Abolish fiat money and reinstitute sound money, backed by

real commodities. Ideally, make all currency backed once

again 100% by gold - the only money that has evolved over time via

the true free market in money. [George Reisman explains very simply how to go

about it.] Note that gold (and to a lesser extent silver)

is "market" money, whereas as fiat money is government

money - backed by force. - Change the laws so that banks must hold 100% of all

demand deposits in reserve - and put an end to all fractional

reserve banking. Make banks behave like any other business

- and to ensure no fraud takes place. - Close down/abolish all central banks.

- Remove the issuance of money from the government's

hands - because as long as they control its issuance, either

directly or via their central bank proxies, they can and will

manipulate it to their own political advantage. - Allow private banks to issue money -- 100% backed by

gold -- and keep them in line via anti-fraud legislation,

i.e. legal provisions to ensure they do not lend any more

than what they have on deposit. In other words, end fractional

reserve banking. - Do away with national fiat currencies and floating exchange

rates. Instead, allow gold to become the naturally evolved

global currency - a money fully backed by something which

cannot be manipulated by banks OR politicians. - Establish a free banking, non-fractional reserve, 100%

gold-backed global monetary system - the only monetary

reform that attacks the problem at the root, and the only

reform that will not only abolish boom/bust, but will bring

about a rational international system of exchange. - Abolish the "boom and bust" mentality and reality, and

allow purchasing power to increase over time, as production

grows in relation to the gold held as currency backing.

Any monetary "reform" that does NOT attack the cause of the

problem - fractional reserve banking and monopolised banking

using fiat money - is doomed to failure.Don't let those who have caused the problem in the first

place be the only ones writing the "rules" of reform - because

you can bet your bottom dollar, it will not be the reform we

need or want.

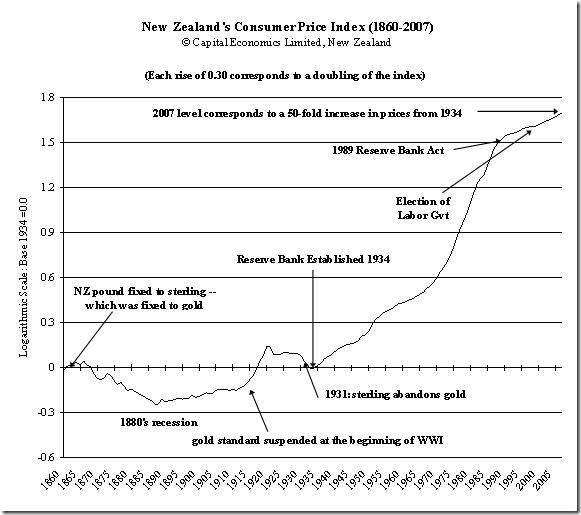

If you think the proposal is crazy, or that commodity-backed or gold-back money doesn't work, or leads inevitably to instability, then just see how things worked out in New Zealand and Britain in the nineteenth-century, back before our money was nationalised. What you see below (which shows The Course of Prices in NZ, 1960-1910) is a stable currency in both countries, gently easing prices and increased purchasing power for every pound in your pocket-- which effectively means increasing real wage levels and more prosperity for all -- with no great schocks or monetary booms and busts -- and this is despite the over-borrowing by the likes of Julius Vogel:

And compare that to all the ups and downs in the price levels over the twentieth century once the gold standard was abandoned in 1914, and money was finally completely nationalised in 1936, two years after the Reserve Bank's founding in 1934 [graph courtesy Bryce Wilkinson from Wellington's Capital Economics Ltd, referenced in Frederic Sautet's article: 'The Disastrous Effects of Central Banking: Let’s Get the Story about Inflation in New Zealand Straight.']

Anyway, David McGregor concludes (and I thoroughly approve his recommendation):

For a complete theoretical and practical exposition on all of

the above - and a rigorous assertion of the viability of a 100%

gold backed currency and non-fractional reserve banking, I

recommend you download the following e-book. At 876 pages

it's not your average bedtime read, but if you have any interest

at all in where all this is headed, then you owe it to yourself

to discover why it has happened and the only sure way to prevent

it happening over and over again in the future."Money, Bank Credit And Economic Cycles"

By Jesus Huerta de SotoPublished by the Ludwig von Mises Institute and available for

free download here: http://mises.org/books/desoto.pdfLike I said, it's a BIG book - but even if you only read

certain chapters, the ones that immediately interest you,

you will already be better informed on this crucial subject

than all your "leaders" put together!

To get a heads up on the brilliance of De Soto's analysis, listen to this richly explanatory recent interview while you sort out your download, and check out his article: Financial Crisis & Recession.

12 comments:

Good analysis of recent price movements etc but my only problem with this as a general explanation of all boom and bust cycles how does it explain two of the most famous bubble - the tulip bubble and the South Seas Bubble?

IT seems to me that the ability of finance bubbles to fund product bubbles has hugely increased since the invention of Central Banks but product bubbles existed before then and will no doubt occur again.

However, they will not be as damaging without the consequent symbiotic finance bubble.

Indeed there were benefits from the tulip bubble and especially in the development of financial institutions which supported the growth and development of trade in Europe and the UK.

Hi Owen,

Bubbles can certainly happen either with or without central banks or their fractional reserve cousins, but as you say "the ability of finance bubbles to fund product bubbles has hugely increased since the invention of Central Banks." [See ''Bubble, bubble, housing and trouble' for more on this].

The extra damage that the central bank does comes about because their monetary inflation and interest rate manipulation doesn't just create a consumer bubble that grows without fundamental support -- bubbles that should be as obvious as a pyramid scheme -- it stuffs up up the whole 'early part' of the capital structure, causing malinvestments in the 'higher order' capital goods, while stimulating an unsustainable consumer boom at the same time. [See 'How the Business Cycle Happens' for a bit more of an explanation of what that means, and if you're really keen and like lots of charts, Roger Garrison's Powerpoint display 'Time & Money'shows how interest rate manipulations set up the whole boom-and-bust cycle.]

So it's more than just a bubble -- it's a worm at the very heart of the economy.

Just in case you weren't pissed enough already...

U.S. Federal Reserve, Central Bank to the World

Read it and weep.

I think it's important to separate general manias with what is happening now, a bubble caused by monetary expansion.

There will always be manias and bubbles. They are part of the normal cycle of any system.

But what we have witnessed in recent years is a gigantic expansion of the money supply in a period of masked inflation which has caused an asset bubble. We have also had very lax regulation (sorry boys) which has allowed investment banks to leverage to extreme levels.

The idea that unregulated private banks can be trusted is hopeful at best. The short term incentives in the business preclude long term stability.

Look at GSax. $6bln in from the taxpayer and $7bln out in bonuses.

Who's kidding whom here?

That aside what is the alternative?

You propose a gold backed currency with heavy oversight.

The oversight (or regulation) is the crucial piece in any money system.

You could also have an EBCU (energy backed currency unit).

What about a fiat system with money issued from a heavily regulated state monetary authority?

Where the money supply itself is controlled.

The end game is to have a stable supply of money in the system, not an infinitely expanding one which we have now. Then it's down the the velocity of circulation.

But we will never get away from receipt forms of money (paper or digital).

Goodbye fractional reserve....hello...what exactly will work the best.

Raf

A gold backed currency does not need much regulatory burden at all.

If an institution issues a currency instrument that can't be exchanged for gold on presentation, then it is akin to a bad cheque. Such things are readily detected. In such a case the issuer of the currency is going to get done for simple fraud. Executives, managers and directors don't enjoy getting done for fraud very much. They tend to avoid behaviours that would get them chucked into a small room with a big guy called Lil'Momma who's primary activity over the past ten years has been amateur proctology.

Fiat money is excluded from consideration as a proper currency since it is unbacked by asset. If there is no gold present for the note to represent, then the note should never get printed in the first place. One advantage to this is that you do not require a huge bureaucratic oversight or organisation to analyse and attempt to control "money". Another is that you keep government away from printing money at all.

Over the past century or so people have tried state run schools, state run education, state run housing, state run "businesses" and state run money. None has worked. The present "credit crisis" is exactly a demonstration that nationalised money does not work.

LGM

LGM,

I understand your point but in the past it hasn't stopped Central Banks or Governments or Goldsmiths or whoever from establishing a sound reputation and then once people were convinced the gold was there they ramped up the paper issuance.

History is littered with such occurences.

However i am open to any sound proposal which sorts out the current nonsense. Anything that limits money supply expansion and preserves its value has to be a good thing.

Raf

You mentioned: "I understand your point but in the past it hasn't stopped Central Banks or Governments or Goldsmiths or whoever from establishing a sound reputation and then once people were convinced the gold was there they ramped up the paper issuance."

Rulers, kings and bankers etc. have been into inflation for generations. The point is that they have been ALLOWED to do it and protected from the result by arbitrary fiat. That is one of the troubles with not having strict separation of economy and state.

If these practices are treated as simple fraud and the perpetrators held publically accountable, then they desist soon enough.

Prof Reisman has written a good proposal to sort out the mess and repair the damage as quickly as possible. PC mentioned it recently and provided the link. See what you think.

LGM

PC,

Could you resupply that link please?

Yep, here it is, mate.

It was in the article above. :)

Merci :-)

Good analysis.

Thanks for sharing it.

;-)

I do agree with most of the points but could you please elaborate on the gold currency point your making

thank you

Post a Comment